Reach out to us and join our family ....

We first get to know you and discuss what is most important to you and your family. Then, we allocate your money into various strategies designed to help you pursue those goals.

Let’s start with now …

Our Expertise Includes

Customized financial solutions for your best outcome

Asset Management

College Planning

Disability Income Insurance

Estate Planning

Financial Planning

Group Retirement Plans

Individual Retirement Plans

Investment Strategies

Life Insurance

Retirement Planning

Risk Management

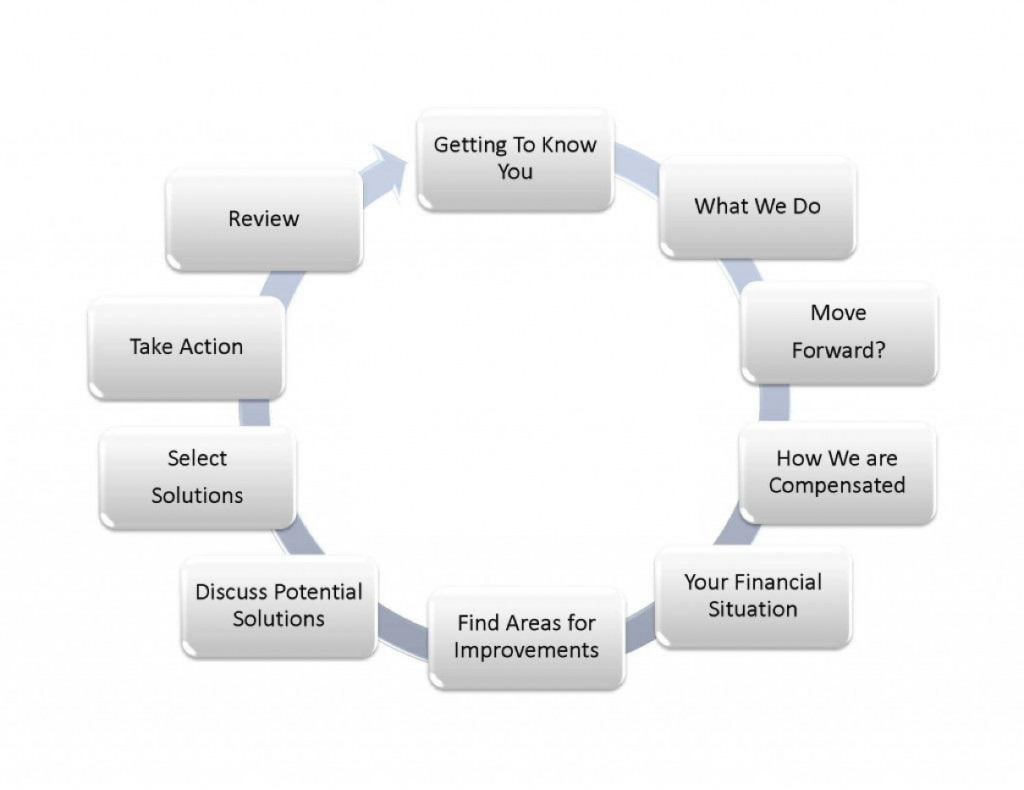

Our Customized Process

Understanding you and your goals

In our initial meeting, we will start by listening.

You’ll see this often in our approach – in order to help you, we need to understand your specific situation – there are no good cookie cutters when it comes to building an effective financial future.

We need to know what you like and don’t like about your current plan, what you think a good financial planner is all about, how you make decisions, and in what form (charts, spreadsheets, text) you’d like to see our recommendations.

What we won’t do in our first meeting is discuss any particular investment, financial product, or specific recommendation. There is plenty of time for that after we make sure we understand your goals.

The Next Steps

After the first meeting, you will do a little homework and fill us in on your key financial details. Then, at our second meeting, we’ll share our findings and discuss how we can work together.

Then, we’ll discuss investment options. We’ll cover your current investment strategies and talk about alternatives that you may not have considered. We’ll demonstrate the pros and cons of different investment approaches.

We’ll also discuss your insurance protection strategy. There is little sense in saving, investing wisely, and then risking your assets with too little insurance or the wrong kind.

We’ll bring it all together!